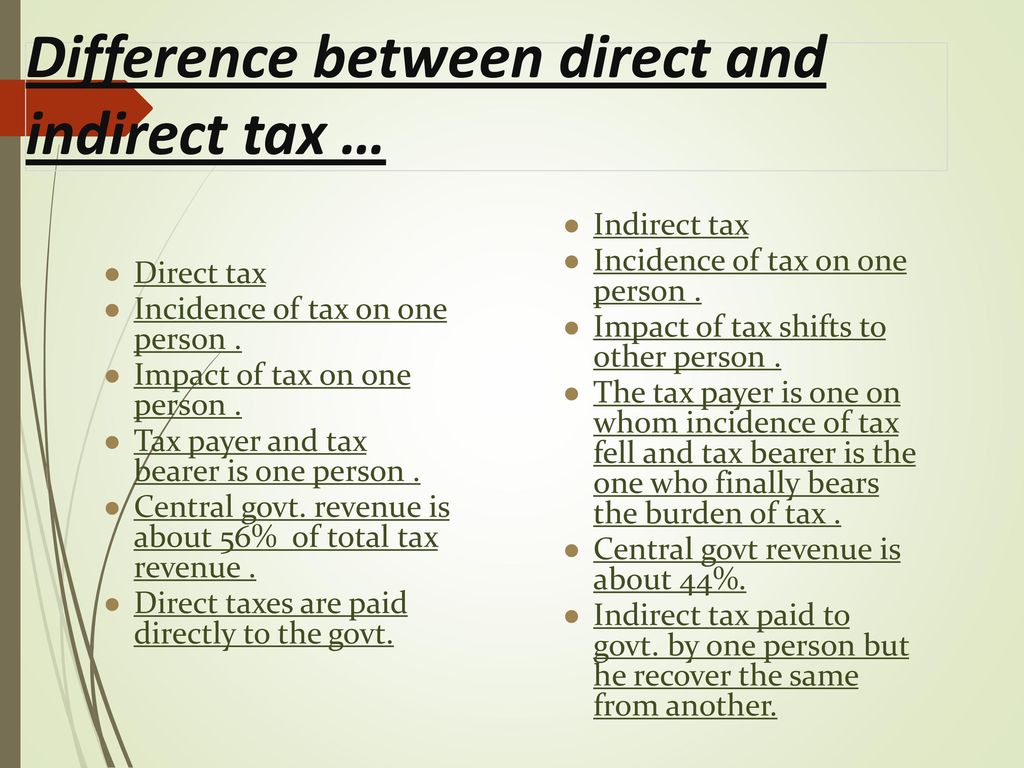

Explain the Difference Between a Direct and Indirect Tax

Similarly a person who earns Rs. Collection of direct taxes is generally economical.

Direct Vs Indirect Taxes What Is The Difference Between Direct And Indirect Taxes Icici Direct Youtube

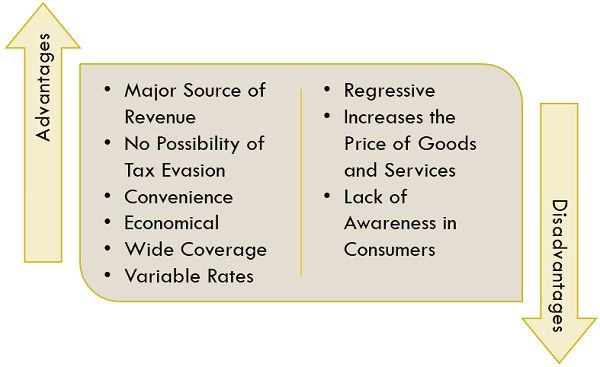

Product control The indirect tax helps in controlling the product purchase.

. Direct tax is levied and paid for. Indirect tax is the tax whose liability to pay and incidence lies on different persons. However the implications of these taxes are quite extensive and complex so you should consider contacting an audit firm so that you can enjoy the reliable efficient and professional services of accountants and auditors and claim tax incentives in Singapore.

Every individual who is not familiar that they are paying the tax will contribute to pay it. Proportionate Flat Tax. This article will explain the difference between direct and indirect taxes.

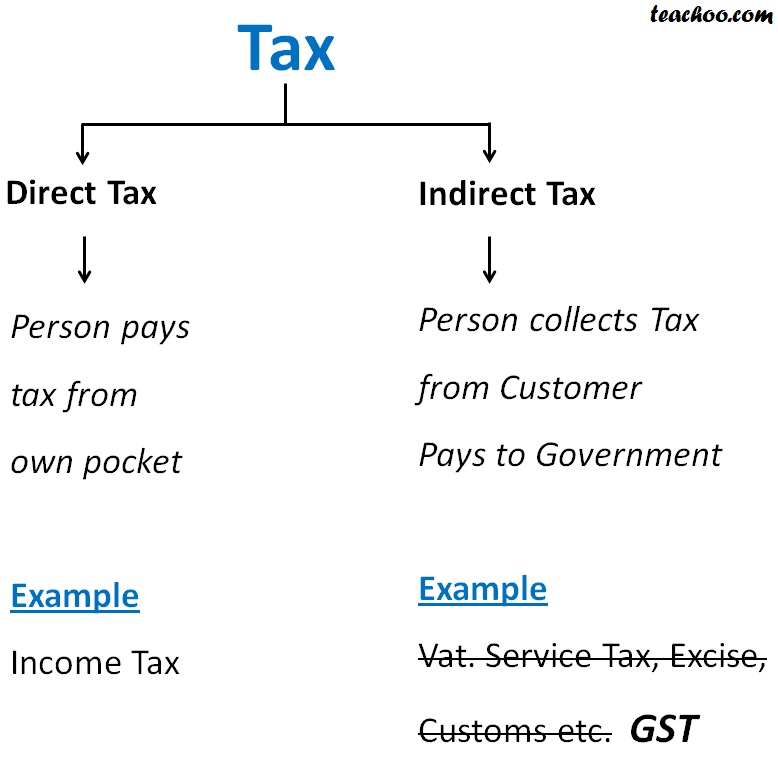

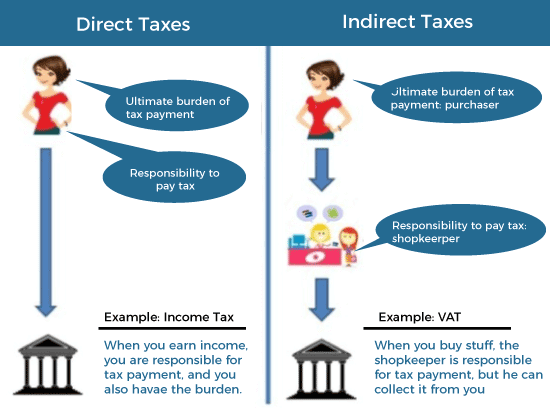

A direct tax is one that the taxpayer pays directly to the government. The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else who then pays it to the government. 6 5 60 of the workforce in Java which contains a large proportion of Indonesias population are rice farmers.

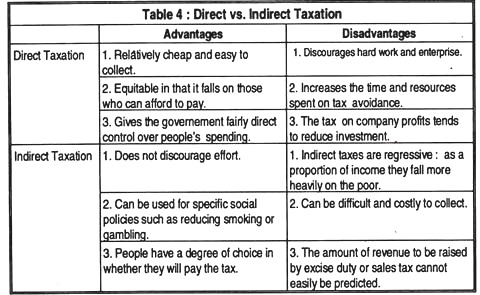

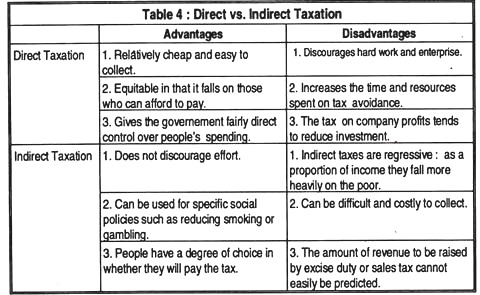

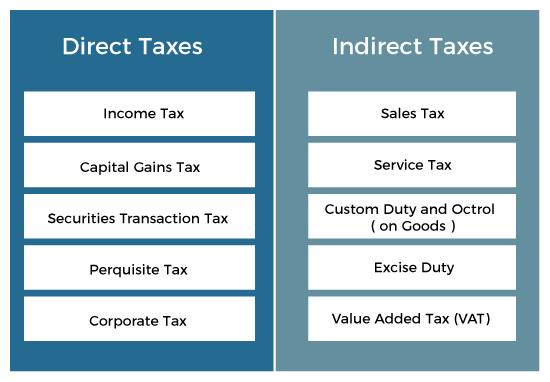

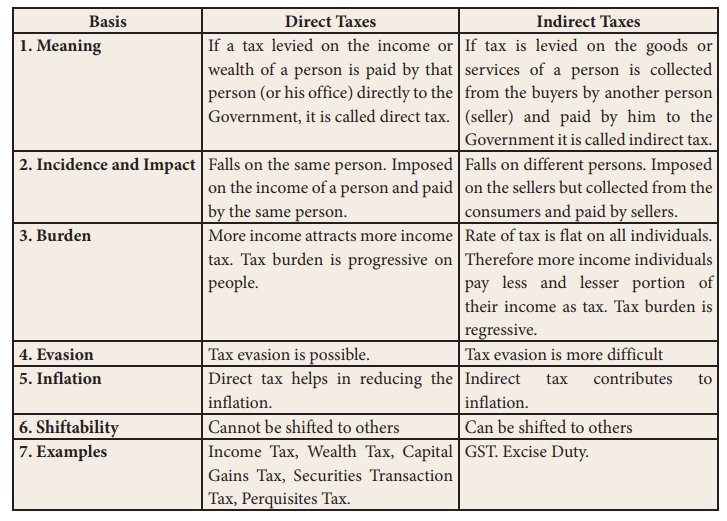

A Explain the difference between direct and indirect tax and identify one direct and one indirect tax in the above statement. Unlike a direct tax indirect tax involves every citizen paying the tax in a minimum amount. 12 rows Direct Tax Indirect Tax.

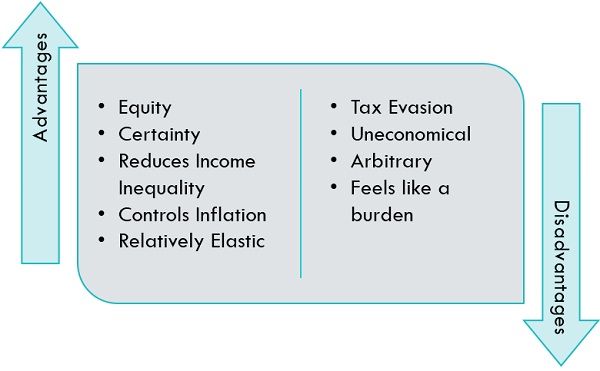

500000 pa will be responsible to pay. The certainty of tax to be paid. Thereby the tax burden falls more on the rich than on the poor.

Paid first by one person but then passed onto another. India having a wide distribution of income earners and sources of revenue is not different. It is to be paid by Individuals and businesses organizations.

The allocative effects of direct taxes are superior to those of indirect taxes. It is imposed on an individual but is paid by another person either partly or wholly. The taxpayer is certain as to how much tax is to be paid as the tax rates are decided in advance.

It is imposed on all goods and services. It is to be paid by End-consumers. There are 2 types of tax in India - direct tax and indirect tax.

Moreover the indirect tax is the final tax is payable by the end consumer of goods or services. Best answer Direct tax is the tax whose liability to pay and incidence lies on the same person on whom it is levied. A tax system that requires the same percentage of income from all taxpayers regardless of their earnings.

The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else who. Difference Between Direct and Indirect Tax. In the case of direct tax the final tax is payable by the person who is being assessed.

Retailers from the ultimate taxpayer ie. The incidence and impact of the tax is on the same person. A major difference between direct and indirect tax is the fact that while direct tax is directly paid to the government there is generally an intermediary for collecting indirect taxes from the end-consumer.

Amount of taxation depends on income and profits generated by individual Tax imposed is to be same for all category of people 4. The Government can influence allocation of resources for production of different goods and services through its budget. The incidence and impact of the tax is on different persons.

While direct taxes are imposed on income and profits indirect taxes are levied on goods and services. One of the major difference between direct and indirect tax is that direct tax is. Direct tax is imposed directly on the taxpayer and is paid by the taxpayer directly to the government.

Direct tax refers to financial charge levied directly. These taxes cannot be shifted to any other person or group. There are broadly three different tax structures.

Direct Tax Indirect Tax It is imposed on the income of a person based on the principle of ability to pay. Must be paid directly to the government by the person on whom it is imposed Indirect. A direct tax is untransferable to other entities while an indirect tax is transferable.

1 It is imposed on income and profits. The income tax burden is equitably distributed on different people and institutions. For instance if a tax is levied at 10 per annum a person earning Rs100000 will be responsible to pay Rs10000 in taxes.

Direct taxes are progressive and they help to reduce. Economical and lower cost mechanism. The same implies for the government where it can estimate the tax revenue from direct taxes.

A Given this information explain why Indonesia is. 6 rows Key differences between Direct and Indirect Tax are. In simple terms direct taxes are payable by the individual or the company that is earning the profit.

4 b Discuss why governments impose taxes. Indirect tax is tax collected by intermediaries for eg. The indirect tax rates vary from product to product.

An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it.

What Are Direct Tax And Indirect Tax Different Taxes In India

Write Any Three Differences Between Direct Taxes And Indirect Taxes Sarthaks Econnect Largest Online Education Community

Direct And Indirect Tax Merits And Demerits Economics

Difference Between Direct And Indirect Taxes Introduction To Indire

Topic Introduction Of Tax And Difference B W Direct And Indirect Tax Ppt Download

Difference Between Direct And Indirect Tax Javatpoint

Difference Between Direct And Indirect Taxes In India

Difference Between Direct Tax And Indirect Tax With Types Advantages And Disadvantages And Comparison Chart Key Differences

What Is Direct Tax Indirect Tax Types Differences Between Direct Tax Indirect Tax Explained Youtube

Difference Between Direct And Indirect Tax Javatpoint

What Is The Difference Between Direct And Indirect Tax Quora

Write Down Four Difference Between Direct Taxes And Indirect Taxes Brainly In

Differences Between Direct Taxes And Indirect Taxes

What Is The Difference Between Direct And Indirect Tax Quora

Direct Vs Indirect Tax Difference Between Them With Definition Comparison Chart Youtube

What Is The Difference Between Direct And Indirect Tax Quora

Difference Between Direct Tax And Indirect Tax With Types Advantages And Disadvantages And Comparison Chart Key Differences

Comments

Post a Comment